Medicare | Steps to Enroll

Enrolling in Medicare

Timing is everything when you’re enrolling in Medicare, and a lot depends on your specific situation. That’s why we organized this enrollment information based on life circumstances.

When you turn 65

Turning 65 is a big life event, and thousands of baby boomers are doing it every day. Here’s what you need to know right off the bat:

- You must be 65 to enroll in Medicare—your spouse’s age doesn’t count.

- You may enroll in Medicare even if you’re not collecting Social Security yet.

- You may enroll in Medicare even if you work past age 65 and have employer coverage, or you are 65 and have coverage through your spouse’s employer.

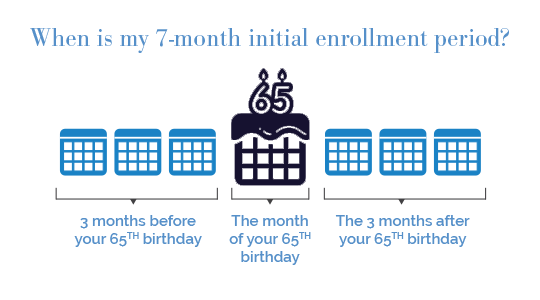

Your first chance to sign up for Medicare is called your Initial Enrollment Period (IEP). It happens around your 65th birthday and lasts a total of 7 months. It includes your birthday month plus the 3 months before and the 3 months after. It’s best to sign up early to avoid gaps in coverage and late enrollment penalties.

You may be enrolled in Medicare automatically if you currently receive Social Security or Railroad Retirement Board benefits. You’ll receive your Medicare card in the mail a few months before your 65th birthday. You still have an IEP during which you may make Medicare coverage decisions.

Working past 65

A lot of people reach the age of Medicare eligibility and continue to work. Many have health insurance through their employers. What about Medicare?

Here’s what you need to know:

- You still have a Medicare Initial Enrollment Period (IEP) when you turn 65. You may want to enroll in Part A during this time. It’s premium free, as long as you or your spouse worked and paid Medicare taxes for at least 10 years.

- You have to be proactive and enroll in Medicare yourself. Medicare doesn’t notify you about your IEP unless you currently get Social Security or Railroad Retirement Board benefits.

- You may qualify for a Medicare Special Enrollment Period (SEP) that allows you to delay enrolling in Part B and Part D without incurring late enrollment penalties. You need to get confirmation of creditable coverage from your employer.

Retirement and Medicare Basics

Retiring soon? Know the Medicare basics. Your Medicare health coverage choices can vary based on your age and whether you have retiree coverage through your employer or plan sponsor. Find out what you need to know and the questions to ask to help you retire with peace of mind.

Get Your Medicare Special Enrollment Period Dates

Your SEP, if you qualify for one, begins when you retire or your employer insurance ends—whichever comes first.

Talk with your employer health insurance plan administrator before you make any decisions. You need to understand if, and how, your plan may work with Medicare. You may be required to take full Medicare benefits (Parts A and B) at age 65 in some situations, such as if your employer has fewer than 20 employees.

During your SEP, you may:

- Enroll in Part B, and Part A, if you haven’t already. You have 8 months to enroll.

- Enroll in a Medicare Advantage (Part C) or a prescription drug (Part D) plan. You have 2 months to enroll.

You are not eligible for this SEP when COBRA or retiree coverage ends. However, you may be eligible for a different SEP. Talk with your plan administrator or call the Medicare helpline for more information.

If You’re on Disability

You may be eligible for Medicare before age 65 if you have a qualifying disability. Eligibility usually starts after you’ve received disability benefits for 24 months.

Here’s what you need to know:

- You’ll be automatically enrolled in Original Medicare (Parts A and B). Your Medicare card will arrive in the mail a few weeks before your eligibility date.

- Your coverage starts the first day of the month you receive your 25th disability check.

- You still have an Initial Enrollment Period (IEP) when you may make decisions about your Medicare coverage.

Your IEP is 7 months long. It includes your 25th month of disability, the 3 months before and the 3 months after.

How to Use Your Initial Enrollment Period

If you do nothing during your IEP, you will be covered by Original Medicare (Parts A and B). However, Original Medicare doesn’t cover everything.

Your IEP is when you may make other Medicare coverage choices based on your needs, such as adding a prescription drug (Part D) plan and Medicare supplement insurance or choosing a Medicare Advantage (Part C) plan. It’s best to act early to avoid gaps in coverage and possible late enrollment penalties.

Medicare and Disability: Other Coverage

If you have other coverage, such as through an employer, you may choose to delay Part B. Follow the directions on the back of your Medicare card to notify Medicare of your decision.

Note that you could be charged a Part B premium penalty if you decide to enroll in Part B later. Your employer must provide creditable coverage, so you may qualify for a Special Enrollment Period and avoid the penalty.

If You Miss Initial Enrollment

Medicare provides a General Enrollment Period (GEP) every year for people who missed signing up when they were first eligible. It’s like make-up time for Medicare enrollment.

The GEP is January 1 – March 31 every year. Here’s what you need to know:

- You can enroll in Part A, Part B or both during this time.

- Coverage begins on July 1 of the same year.

- You may have to pay a late enrollment penalty.

- You may be eligible enroll in a Medicare Advantage (Part C) or a prescription drug (Part D) plan April 1 – June 30 of the same year.

Changing Plans After Enrolling in Medicare

Late Enrollment Penalties

Missing your Initial Enrollment Period can be costly. Medicare Part A, Part B and Part D may charge premium penalties if you miss your initial enrollment dates, unless you qualify for a Medicare Special Enrollment Period.

Medicare Part A Premium Penalty

Part A is premium free if you or your spouse worked and paid taxes for at least 10 years. If you have to pay a premium, the penalty for late enrollment is 10%.

The Part A premium penalty is charged for twice the number of years you delay enrollment. If you wait 2 years, for example, you would pay the additional 10% for 4 years (2 x 2 years). The penalty applies no matter how long you delay Part A enrollment.

Medicare Part B Premium Penalty

The penalty for late enrollment in Part B is an additional 10% for each 12-month period that you delay it.

Let’s say your Initial Enrollment Period ended September 30, 2010, for example. Then you enroll in Part B during the General Enrollment Period in March 2013. Your late enrollment penalty would be 20% of the Part B premium, or 2 x 10%. This is because you waited 30 months to sign up, and that time period included 2 full 12-month periods.

In most cases, you have to pay the penalty every month for as long as you have Part B. If you’re under 65 and disabled, any Part B penalty ends once you turn 65 because you’ll have another Initial Enrollment Period based on your age.

Medicare Part D Premium Penalty

The penalty for late enrollment in a Part D plan is 1% of the average Part D premium for each month you delay enrollment. You pay the penalty for as long as you’re enrolled in a Medicare Part D plan.

You may delay enrolling in Medicare Part D without penalty if you qualify for Extra Help or have creditable drug coverage. If it’s been more than 63 days since you’ve had creditable coverage, then the penalty may apply.

How to Enroll in Medicare

Medicare enrollment happens automatically for some people. Others need to enroll themselves when they first become eligible. It all depends on your situation.

After you are enrolled in Medicare, you need to take action if you want additional coverage, such as a Medicare Advantage (Part C) plan, a prescription drug (Part D) plan or a Medicare supplement insurance plan.

How Automatic Enrollment in Medicare Works

You will be enrolled automatically in Original Medicare Parts A and B if:

- You are turning 65 and are getting Social Security or Railroad Retirement Board benefits.

- You are under 65 and have received disability benefits for 24 months.

- You have Lou Gehrig’s disease (Amyotrophic Lateral Sclerosis, or ALS) and start getting disability benefits.

You will get your Medicare card in the mail a few months before your 65th birthday or before your 25th month of getting disability benefits. You’ll get it immediately if you have ALS.

Keeping the card means you accept Original Medicare Part A and Part B coverage. You also agree to pay Part B premiums. (If you live in Puerto Rico, you need to enroll yourself in Part B; it’s not automatic.)

You must notify Medicare if you decide to refuse or delay Part B. You may want to do this if you have other health care coverage, such as through an employer or union. Follow the instructions on the back of your Medicare card.

How to Enroll in Medicare Yourself

You need to take action to sign up for Medicare if:

- You are turning 65 and are not currently getting Social Security or Railroad Retirement Board benefits.

- You qualify for Medicare because you have End-Stage Renal Disease (ESRD).

- You live in Puerto Rico and want Part B coverage.

You can sign up for Medicare online

You can also enroll in Medicare by phone or in person at any Social Security office. Call 1-800-772-1213 (TTY 1-800-325-0778) Monday through Friday, 7 a.m. to 7 p.m. local time, to make an appointment.

If you live outside the United States and its territories, contact the nearest U.S. Social Security office, U.S. Embassy or consulate, or the Veterans Affairs Regional Office (VARO) in the Philippines.

How to Enroll in a Private Medicare Plan

You may choose to enroll in a private Medicare plan after you complete your initial enrollment in both Part A and Part B. You can choose a:

- Medicare Advantage plan (Part C) with or without drug coverage

- Stand-alone Medicare prescription drug plan (Part D)

- Medicare supplement insurance plan

You can find out about plans offered where you live at Medicare.gov or directly from the insurance companies that offer them. You can apply online, by phone or through a local insurance agent.

Keep in mind that if you don’t get prescription drug coverage when you’re first eligible, you may be charged a premium penalty if you join a plan later. You could also be charged more for Medicare supplement insurance if you wait to buy a plan. In some cases, you could be denied this coverage entirely based on your health history.

Schedule your consultation today!

INSURANCE

© 2024 Our Family Office LLC. All rights reserved.